Strategic Compliance & Defence Guide

CAROTAR 2020 – FTA Benefit Under Scrutiny in India

By Omega QMS

The Central Board of Indirect Taxes and Customs notified the Customs (Administration of Rules of Origin under Trade Agreements) Rules, 2020 (CAROTAR) to operationalise Section 28DA of the Customs Act.

In 2026, CAROTAR is no longer procedural. It is the primary enforcement mechanism governing FTA benefits in India. If you are importing under preferential duty from ASEAN, Japan, Korea, UAE, or Australia — CAROTAR compliance determines whether your consignment clears or gets detained.

What is CAROTAR?

CAROTAR regulates how importers claim preferential customs duty under Free Trade Agreements (FTAs). It empowers Customs to:

- Question origin claims

- Seek cost & value addition data

- Demand Form I

- Suspend FTA benefits

- Initiate verification with exporting country authorities

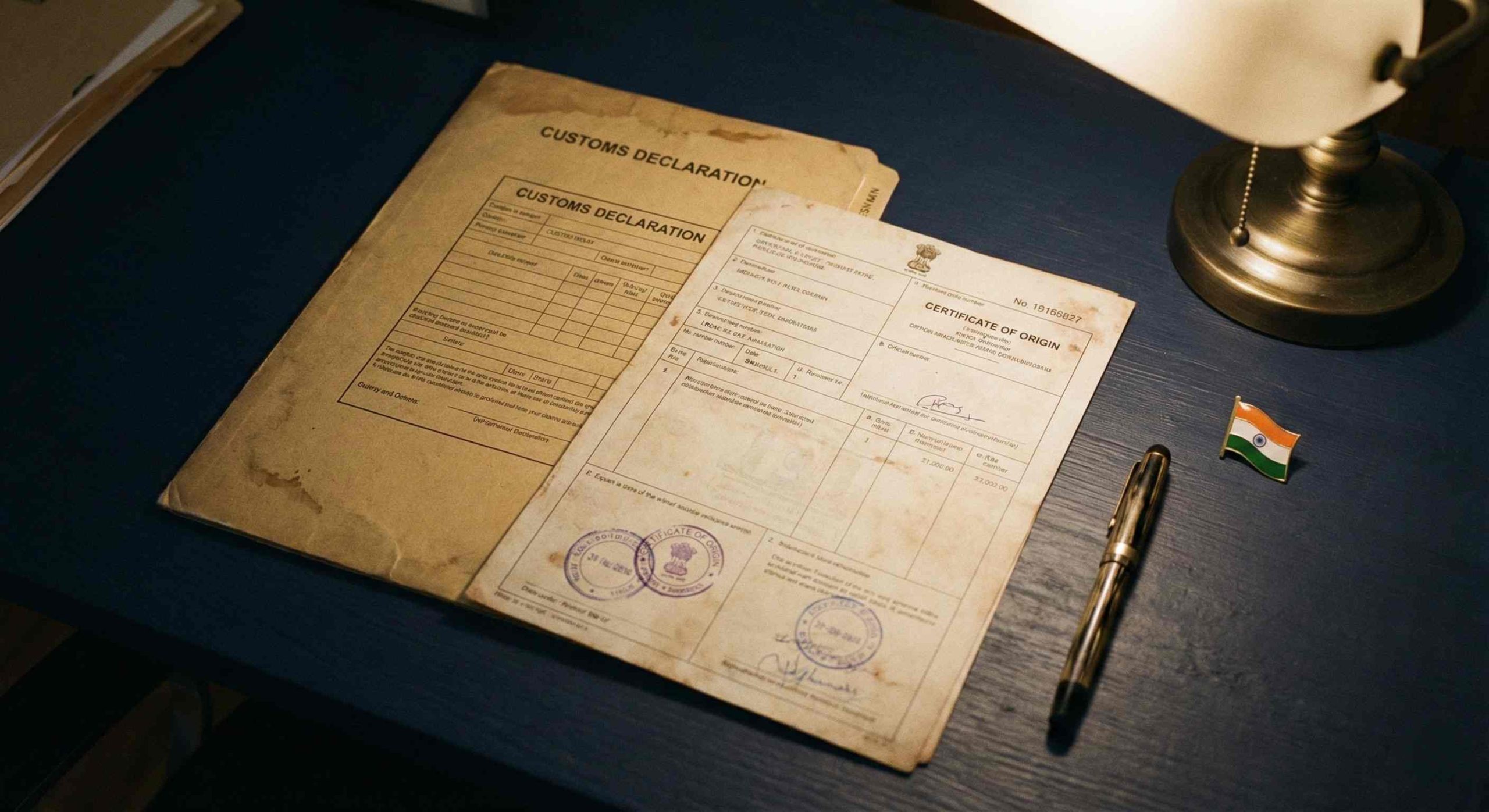

⚠️ A Certificate of Origin (CoO) is not conclusive proof. The burden of proof lies on the importer.

Why CAROTAR Has Become High-Risk in 2026

Customs authorities are actively reviewing:

- 35% / 40% Regional Value Content (RVC) cases

- Change in Tariff Heading (CTH/CTSH) compliance

- Third-country raw material usage

- Minimal processing in ASEAN jurisdictions

- Trans-shipment structures

- Legacy investigations being linked to fresh imports

Agreements most frequently examined include:

- ASEAN-India Free Trade Area

- India-Japan Comprehensive Economic Partnership Agreement (CEPA)

- India-Korea Comprehensive Economic Partnership Agreement (CEPA)

Key Compliance Obligations Under CAROTAR

1️⃣ Due Diligence by Importer

Importer must independently verify that:

- Origin criteria is satisfied

- RVC calculations are correct

- Manufacturing process meets FTA rules

- Product-specific rules (PSR) are complied with

Blind reliance on supplier declarations is insufficient.

2️⃣ Mandatory Documentation

Importer must maintain:

- Certificate of Origin

- Costing sheets

- Bill of Materials

- Value addition workings

- Manufacturing flow chart

- Supplier declarations

- Origin calculation methodology

Customs may demand these at assessment stage.

3️⃣ Form I Requirement

Upon query, importer must file Form I with:

- Origin details

- Supporting documents

- Self-declaration

Failure to respond properly can lead to denial of benefit.

Consequences of Non-Compliance

- Denial of preferential duty

- Differential duty demand

- Interest liability

- Penalty exposure

- Consignment detention

- Possible DRI scrutiny

CAROTAR disputes are increasingly escalating into high-value litigation.

High-Exposure Sectors

We are seeing repeated origin scrutiny in:

Electronics & IT Hardware

Auto Components

Copper Products

Chemicals

Footwear

Industrial Inputs

Particularly where sourcing involves Malaysia, Indonesia, Thailand, Vietnam, or Japan.

Omega QMS – Strategic CAROTAR Advisory

At Omega QMS Pvt. Ltd., we approach CAROTAR matters as strategic regulatory defence assignments — not routine customs queries.

Our services include:

✔ Pre-Import Origin Risk Audit

Technical review of RVC and PSR compliance before shipment.

✔ FTA Structuring Advisory

Aligning sourcing models with defensible origin positions.

✔ CAROTAR Defence Documentation

Structured preparation of RVC workings, origin justification notes, and legal submissions under Section 28DA.

✔ Representation Before Customs / CBIC

Escalation strategy where consignments are detained or benefits suspended.

✔ Legacy Origin Dispute Resolution

Handling cases where historical matters are being linked to fresh consignments.

Why Proactive Compliance is Critical

The cost of post-detention defence is exponentially higher than structured pre-import planning. Every day a consignment sits detained, duty demands compound, supply chains stall, and legal costs escalate — all of which are avoidable with structured pre-import review.

✅ Pre-Import Planning

- Origin risk identified early

- Documentation prepared in advance

- Sourcing structure aligned to PSR

- Predictable, manageable cost

❌ Post-Detention Defence

- Duty demands with interest

- Supply chain disruption

- DRI scrutiny & penalties

- Exponentially higher legal costs

In today’s enforcement environment

FTA eligibility is not enough.

Origin defensibility is everything.

🚨 Is Your FTA Claim CAROTAR-Ready?

If any of the following apply, do not wait for Customs to act first:

Immediate structured intervention is advisable.